Direct debit for marketing services

Ezypay are the best direct debit provider for marketing businesses. Spend less time on lengthy administration processes and more time on billable hours with automated direct debit payment collection.

Frictionless payments to help grow your marketing business

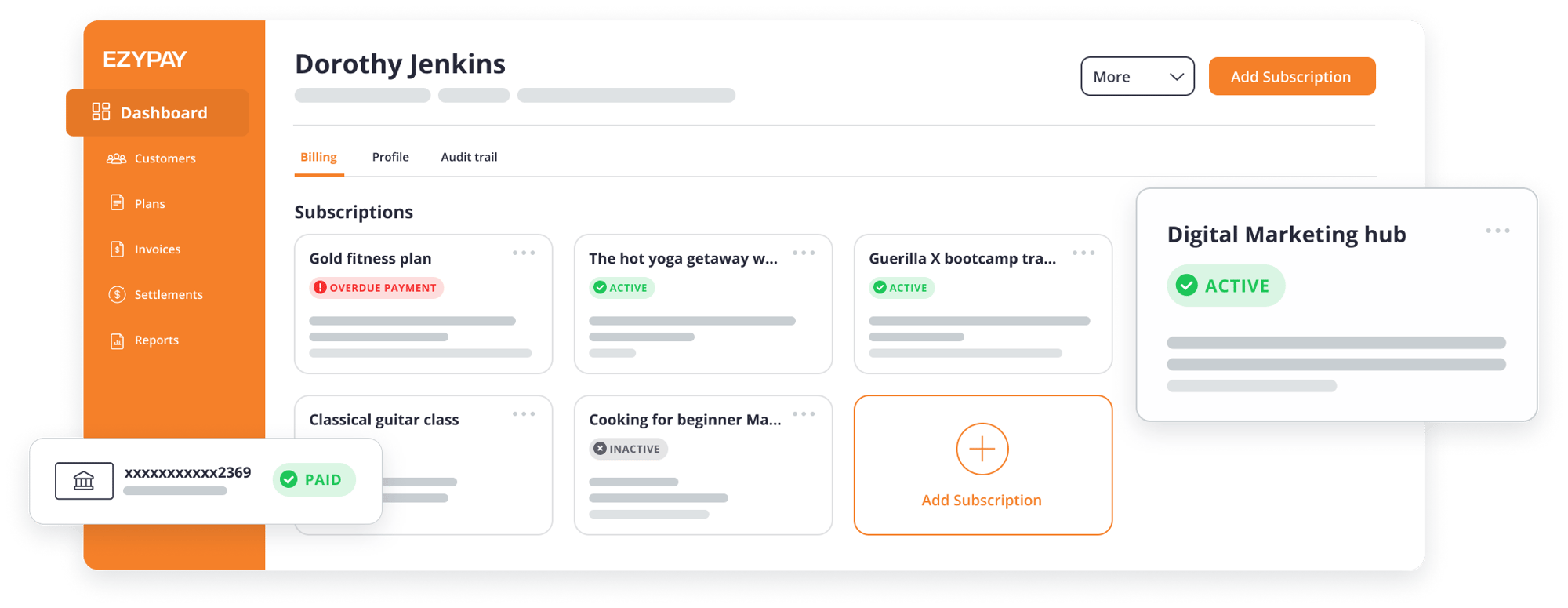

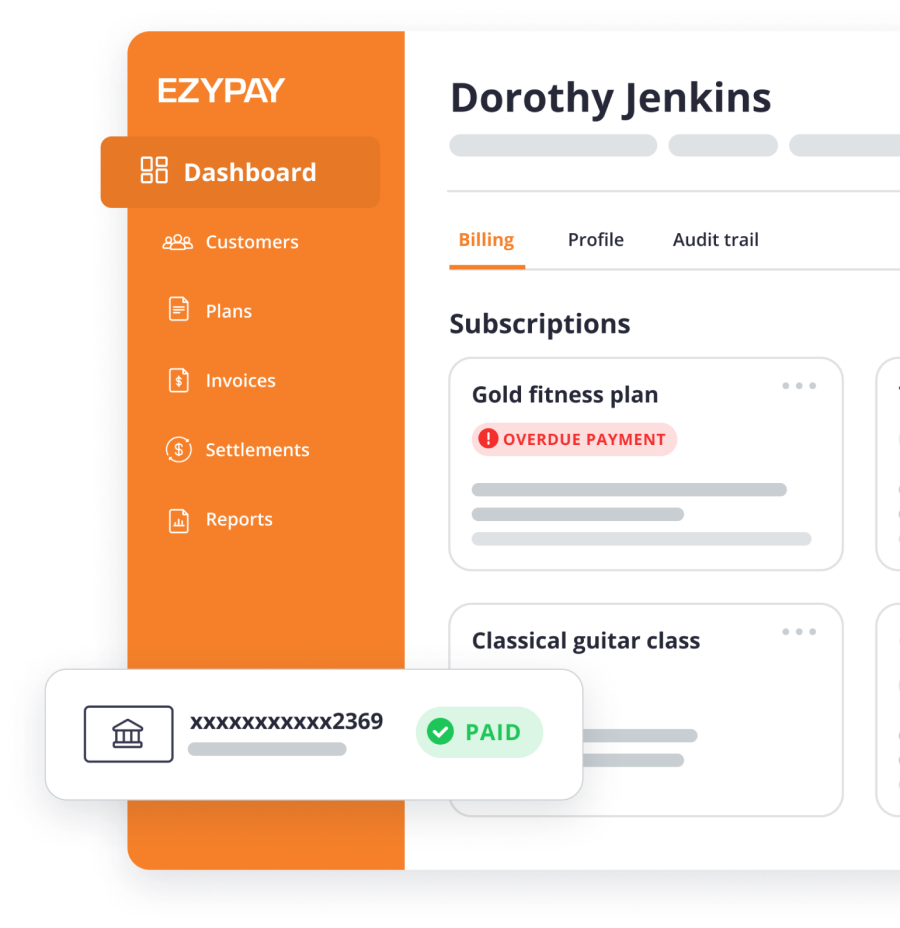

Ezypay’s advanced payments software maximises collection rates and provides a frictionless payment experience for marketing services. Our stand-alone solution will help you spend less time on unnecessary administration and more time on your clients.

Effortless payment processing

Increase cash flow and retention

Maximise your cash flow and collect client bills faster with Ezypay’s regular, on-time and automated direct debit for agencies. Our system has a proven track record, collecting over 50% of payments that fail on the first try. Your clients will be automatically notified of a failed payment and given multiple alternatives to complete the payment.

Grow your agency with confidence

Grow your business with confidence through Ezypay. With our recurring direct debit payments, Ezypay has proven capabilities for marketing businesses and agencies across the APAC region. What’s more, the flexibility of Ezypay software allows it to be completely scalable with your marketing or advertising agency. The cutting edge technology is built with a powerful toolkit which enables it to act as the perfect support for any type of business.

Ensure the highest level of Security

The cloud platform used by Ezypay is PCI DDS (Payment Card Industry Data Security Standard) accredited and is compliant with the relevant Australian and local country banking rules and regulations. Ensure your clients’ direct debit payment collection, billing, and payment processing are achieved at the highest level of security. Make compliance our job, not yours.

Get started for free

There are no upfront costs to use Ezypay's marketing solutions and direct debit payments. You don’t even need to obtain a business or merchant bank account to start accepting direct debit and credit card payments. Simply apply online and activate your account to begin exploring the potential for your business. Managing and automating recurring direct debit payments for client fee collection has never been easier and more cost-effective.

Free up time from manual billing

Save time and money with direct debit system for marketing services. Easily create bespoke payment plans for your business by setting direct debit instructions such as frequency of payments, amounts to be collected, and payment methods. Say goodbye to manually entering your repeat payment collections and processing. Automate through Ezypay, and we'll manage it for you.

Want to learn more about Ezypay?

Simply fill in the form and our Payments Specialists will be in touch to discuss your needs and advise on the Ezypay features best suited to your marketing business. They can also answer any questions you may have to prepare your business for automated subscription billing.

Got a question about pricing?

All pricing plans include multi-site management on one account, cross border settlements which allows you to collect debit across different countries, multi-currency settlement (e.g. sell in NZD but collect in AUD), online payment plans and an online payment gateway to collect failed debits.

There is no minimum monthly transaction amount or value you must reach and fees can be paid by either the club or passed down to your parents or players.

Best of all there is no set-up fee or monthly fees to keep you going.

Your questions answered

Do you have a question about setting up an Ezypay account? We’re here to help. Browse through the most common FAQ or contact us directly to ask your own question.

Contact us

What fees does Ezypay charge?

Ezypay charges fees for loading clients onto a payment play (load fee) and transaction fees for each transaction. There is also a fee charged each time a payment fails known as a failed payment fee.

Fees can be paid by either the business or the clients. Ezypay does not charge a monthly or ongoing fee to use our payments services

Can a client sign themselves up to a payment plan?

How quickly will I receive the money after it has been collected from my clients?

This depends on your chosen distribution cycle (i.e. weekly or monthly). Weekly distributions are collected from Saturday to Friday and funds are transferred into your business account on the following Wednesday.

If you prefer to have collected funds transferred on a monthly basis, monthly distributions collected throughout the month will be transferred into your account after 3 business days the following month.