Customer retention 101

- August 07, 2024 ⎯ 6 mins read

Did you know that it has been estimated to cost around five times as much to attract a new customer, than it does to retain an existing one? This is why it’s important to focus on retaining your current customers by offering ongoing value while building loyal relationships with them. Maintaining strong relationships with your existing customer base brings numerous benefits, including avoiding expensive and effort-intensive prospecting and acquisition campaigns.

If your business is already utilising recurring direct debit payments, you’re on the right track. Here’s how to get the most out of your current customer base to help unlock stronger growth potential.

Why a customer-focused approach to retention is essential

A business that is customer-focused starts by identifying its customers’ needs – building outward from there. So, it’s not about making a customer’s needs fit the product, but the product to fit the customer.

This is critical to success today because, in our digital age, information and choice are abundant. If your offering doesn’t fit your customers’ needs on their terms and their preferences, they will go to another company.

An organisation that puts its customers at its core by striving to maintain a positive relationship with them on an ongoing basis is on the right track to building healthy and profitable relationships.

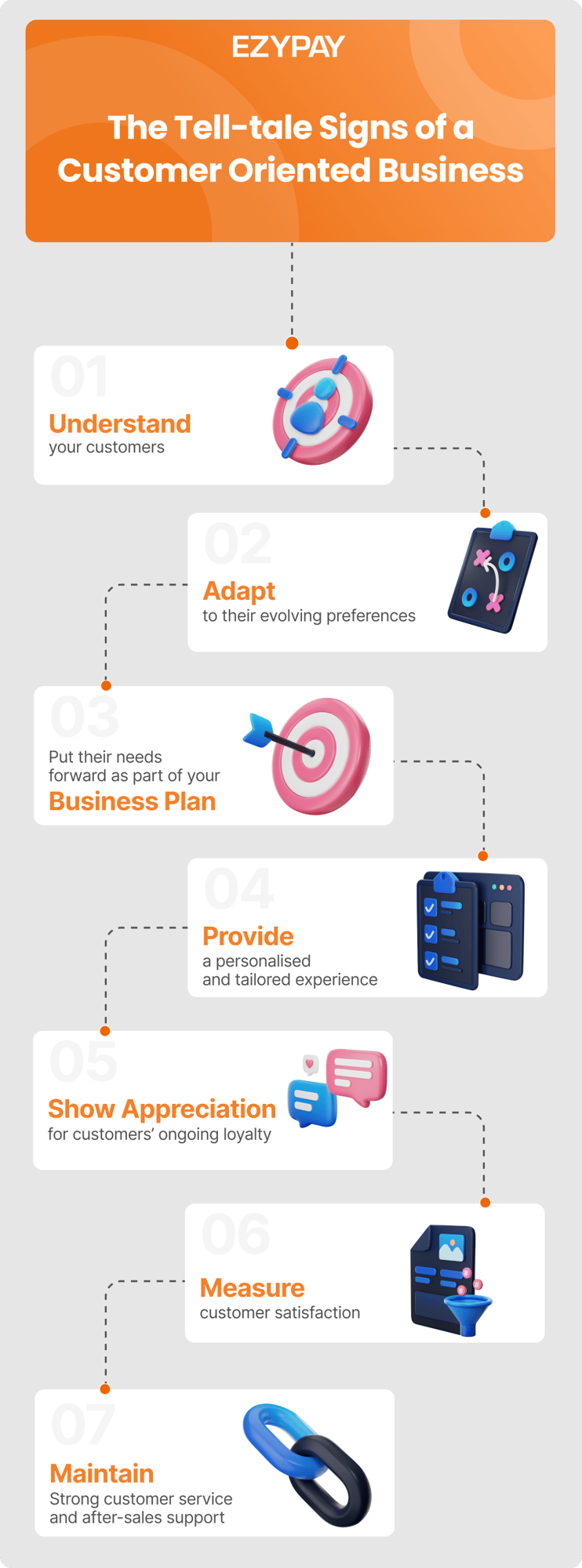

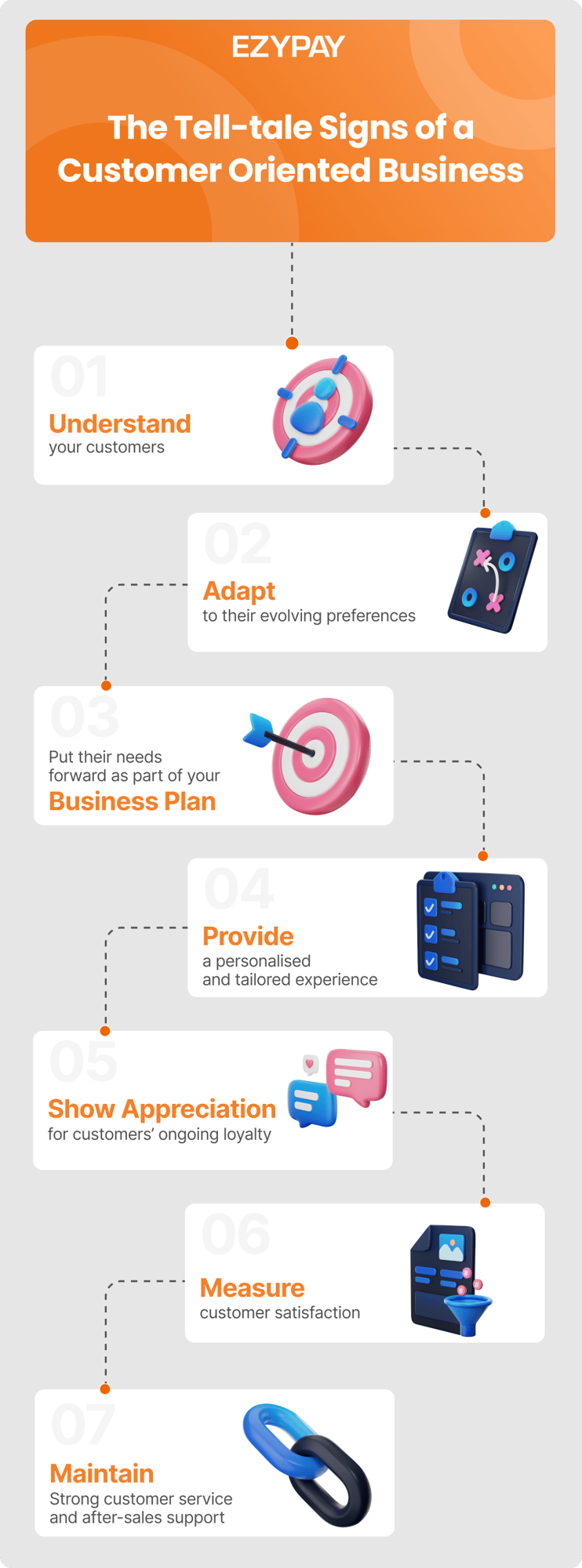

How to tell if my business is customer-oriented?

Customer-oriented businesses emphasise:

- A true understanding of its customers

- Adapting to their evolving preferences

- Putting their needs forward as part of the business plan

- Providing a personalised and tailored experience

- Showing appreciation for their customers’ ongoing loyalty

- Measuring customer satisfaction as part of their success indicators

- Maintaining strong customer service and after-sales support

This approach leads to positive word-of-mouth, longevity and a favourable reputation in the market, all of which are conducive to business profitability and growth.

The reality is - if your customers are displeased with their experience with your business, they will find a competitor who is better at it. To remain in business, your organisation is forced to spend more time and resources attracting new customers.

All of this highlights the importance of focusing on your current customers to keep them happy. So, what is the best way to do this?

How does direct debit billing help with customer retention?

A business that utilises recurring direct debit billing for its customers in exchange for regular products and services naturally fosters customer retention.

This is because you are already providing ongoing value. Services like fitness training and utilities, and products like wine and shavers, are all examples within industries that effectively retain their loyal customer base by offering them an ongoing relationship.

This model, referred to as subscription billing, removes all of the hurdles and inefficiencies around prompting audiences to make a repurchase, and instead, shifts the focus on nurturing customer relationships. Ultimately, these subscription businesses build their long-term client base and retain them effectively through continual and personalised service.

How do I keep growing my Subscription Business?

Successfully retaining your customer base with subscription billing lays strong foundations for future business growth and expansion potential.

Unlock your business's true potential with subscription billing and turn customers into loyal advocates with Ezypay – contact us today to see how Ezypay helps you retain your customer base as you scale your business

Know of another small business owner struggling to retain their customers as their business grows? Feel free to drop them a link to this article via the share buttons below.