Direct debit for childcare

As an award-winning payments solution provider, Ezypay is proud to offer a secure, paperless direct debit system for childcare centres. Our flexible direct debit collection technology is perfectly suited for collecting, processing and managing childcare fees for your OSCAR or OOSH businesses.

Frictionless payments to help grow Childcare businesses

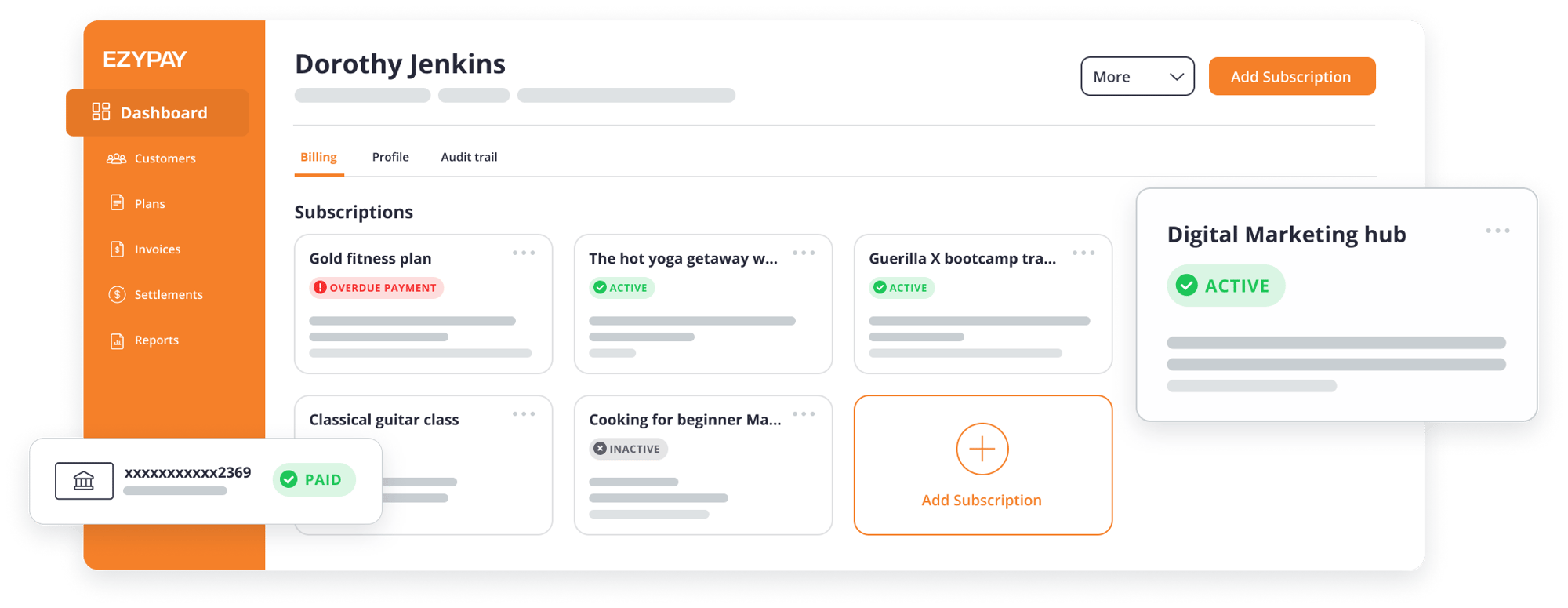

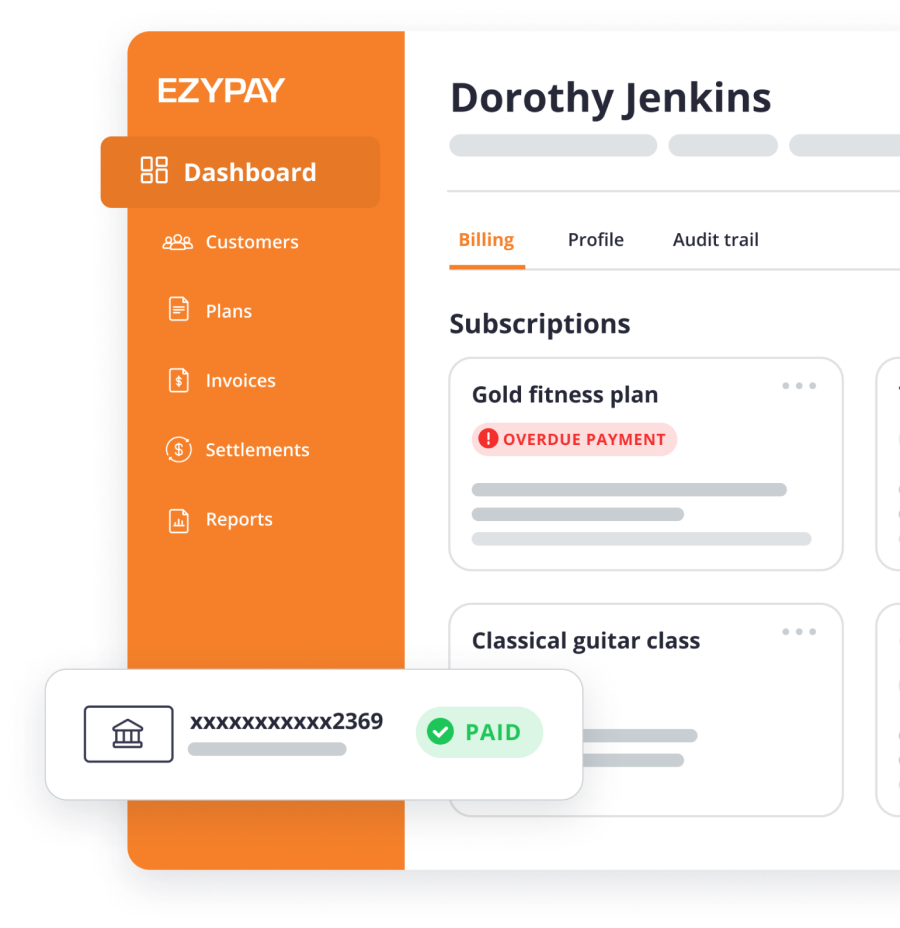

Ezypay’s advanced payments software maximises collection rates and provides a frictionless payment experience for childcare businesses. We work with innovative childcare platforms to provide embedded payment solutions that support the growth of childcare business. Whether you need an API-driven payment integration or a standalone platform, Ezypay is built to improve your cash flow and operational efficiency.

Effortless payment processing

Improve collection rates and cash flow

Maximise cash flow and get paid faster with regular, on-time and automated direct debit payment collection. Ezypay has a proven track record of collecting over 50% of failed payments that do not go through on the first attempt. We automatically notify and rebill parents and provide them with multiple payment options to resolve their payment.

Variety of reports for all key data

With Ezypay, generate up to nine financial reports and analyses built to answer the most frequent and crucial financial concerns and queries. Childcare operators can use these reports for seamless reconciliation and to inspect valuable data regarding monthly direct debits. Comply with receipting and reporting with Ezypay’s power of automation.

Provide payment options

Offer parents payment options with Ezypay direct debit for childcare. Ezypay accepts bank direct debits, debit card and credit card payments via Visa and MasterCard. Increase your revenue and cater to a wider group of parents by supporting multiple payment methods with Ezypay. Our responsive online forms work across multiple channels and devices.

Security and compliance

Ezypay’s direct debit for education solution is PCI DDS (Payment Card Industry Data Security Standard) accredited and conforms to all relevant Australian, and local country banking rules and regulations. We make sure that all your direct debit and credit card handling, billing, and payment processing is achieved at the highest level of security. Let us take care of compliance for the payments coming into your educational institute.

Expand with leading technology

Grow your institute with confidence. Ezypay has proven capability across the APAC region and is ready to scale with your organisation. The Ezypay software is built with a powerful toolkit and has the flexibility to support and scale with any type of business – whether you’re a Registered Training Organisation, University, or other education institution.

Meet our Childcare partners

Infocare

Infocare Solutions is a New Zealand-based childcare management software solution.

.png?width=1490&height=620&name=Aimy%20Logo%20(002).png)

Aimy

Aimy, a cloud-based software solution, simplifies child program management with real-time booking and financials as a service.

Want to learn more about Ezypay?

Simply fill in the form and our Payments Specialists will be in touch to discuss your needs and advise on the Ezypay features best suited to your childcare business. They can also answer any questions you may have to prepare your center for automated subscription billing.

Success stories

“Once it's set up, it's hassle-free for the parents. They don't have to worry about it. The same for us, because it's just automatic."

Jan Morgan

Executive Assistant at Barnardos New Zealand

"In conjunction with its partnership with Aimy, Ezypay offers a provider friendly payment portal that we've used to great success and satisfaction of our customers."

Sachin Ram Narayanan

Director at Kids Knection

Absolutely, Ezypay has been fantastic to work with. It’s been a great partnership and always been fantastic to work with everyone in the team.

Ally Tarr

Head of Customer Success, AIMY

In conjunction with it's partnership with Aimy, Ezypay offers a provider friendly payment portal that we've used to great success and satisfaction of our customers.

Sanchin Ram Narayanan

Director, Kids Knection

Once it's set up, it's hassle free for the parents. They don't have to worry about it. The same for us because it's automatic.

Jan Morgan

Executive Assistant, Barnardos NZ

Your questions answered

Do you have a question about setting up an Ezypay account? We’re here to help. Browse through the most common FAQ or contact us directly to ask your own question.

Contact us

What fees does Ezypay charge?

Ezypay charges fees for loading parents and carers onto a payment play (load fee) and transaction fees for each transaction. There is also a fee charged each time a payment fails known as a failed payment fee.

Fees can be paid by either the business or the parents and carers. Ezypay does not charge a monthly or ongoing fee to use our payment services

Can parents and carers sign themselves up to a payment plan?

How quickly will I receive the money after it has been collected from my parents and carers?

This depends on your chosen distribution cycle (i.e. weekly or monthly). Weekly distributions are collected from Saturday to Friday and funds are transferred into your business account on the following Wednesday.

If you prefer to have collected funds transferred on a monthly basis, monthly distributions collected throughout the month will be transferred into your account after 3 business days the following month.