Intelligent payment solutions for businesses of all sizes

Ezypay enables fast payment processing across APAC, whether you need an integration with your existing software or a market-ready payment solution.

Grow your revenue with frictionless payments

Ezypay’s advanced payments technology boosts collection rates and delivers an exceptional payment experience. Our cloud-based subscription platform makes it easy to manage recurring and one-off payments across multiple sites, payment methods, and currencies.

We partner with innovative technology platforms to support your business growth, whether through embedded payments or integrated solutions tailored to your needs.

Ezypay Features

Explore our payment processing platform

Automated Payments

Improve company cash flow and save time on administration.- Create bespoke payment plans to collect recurring and one-off payments automatically

- Reduce payments-related administration

Payments & Invoicing

Securely accept multiple payment methods and provide customer choice.- Accept payments from bank accounts, digital wallets, PayTo, Visa, Mastercard, American Express and local South Korean Cards. (Payment method offerings vary per region)

- Process international credit and debit cards

Failed Payment Handling

Maximise collections and recoup lost funds without manual intervention.- Recover more than 50% of payments that fail on the first attempt

- Send smart alerts to customers throughout the payment cycle

International Payments

Tap into payment experience across multiple countries in Asia Pacific.- Strong relationships with local banking partners

- Process a broad range of international currencies

- Access customer support locally

Customer Management

Simplify the online sign-up process and keep customers informed.- Convert prospects quickly using responsive forms

- Onboard new customers seamlessly

- Migrate from other payment providers

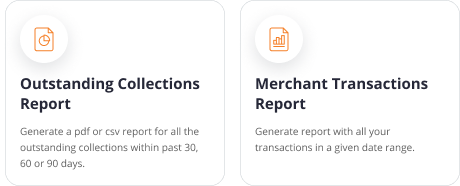

Reporting & Analytics

Generate a range of financial reports to make swift, informed decisions.- Automate and analyse a range of inbuilt financial reports

- Reconcile accounts effortlessly

- Integrate data with accounting software

Discover our partners

Learn more about Ezypay

Integrate with Ezypay

Build smarter payment experiences with flexible APIs, webhooks, and custom payment integrations.

Ready to know more about Ezypay?

Share your details and our team will get back to you soon.