Intelligent payment solutions for businesses of all sizes

Ezypay enables fast payment processing across Asia Pacific, whether you need an integrated solution or a standalone platform.

Go frictionless to grow your revenue

Ezypay’s advanced payments technology maximises collection rates and provides a second-to-none payment experience. Our cloud-based subscription payment platform enables you to manage recurring and one-off payments across multiple sites, payment methods and currencies.

We work with innovative technology platforms to support the growth of your business, whether through frictionless embedded payments or a standalone solution.

Explore our payment processing platform

Automated Payments

Improve company cash flow and save time on administration.- Create bespoke payment plans to collect recurring and one-off payments automatically

- Reduce payments-related administration

Payments & Invoicing

Securely accept multiple payment methods and provide customer choice.- Accept Visa, Mastercard, American Express, bank accounts and PayTo (varies by country)

- Process international credit and debit cards

Failed Payment Handling

Maximise collections and recoup lost funds without manual intervention.- Recover more than 50% of payments that fail on the first attempt

- Send smart alerts to customers throughout the payment cycle

International Payments

Tap into payment experience across multiple countries in Asia Pacific.- Strong relationships with local banking partners

- Process a broad range of international currencies

- Access customer support locally

Customer Management

Simplify the online sign-up process and keep customers informed.- Convert prospects quickly using responsive forms

- Onboard new customers seamlessly

- Migrate from other payment providers

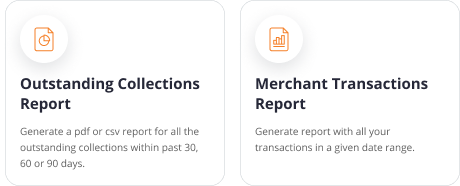

Reporting & Analytics

Generate a range of financial reports to make swift, informed decisions.- Automate and analyse a range of inbuilt financial reports

- Reconcile accounts effortlessly

- Integrate data with accounting software

Integrate Ezypay to customise your software

Flexible APIs and our cloud platform enhance your software with a fully customised payment integration. See how an Ezypay integration works to generate revenue.

Collect payments fast with our standalone solution

Supercharge your cash flow by automating regular payments through Ezypay. Find out how to offer more payment options, configurable to when and how customers want to pay.